Actual implementation examples

at Tokyo Institute of Technologies and Tokyo University

・Exercise class in the first year of the master’s course

・Concentrated experiment for 2 days

・Half a day was reserved for orientation

・One week was given for agent creation

・Half a day tournament

・Exercise class in the third year of University

・Twice a week, for 6 weeks

Curriculum(Tokyo University)

エージェントキットの作成

(1) Description of index futures, U-Mart and agent

development kit

(2) Experiencing U-Mart through manual trade

(3) Creation of agent (self-study or homework)

(4) Strategy presentation/tournament(First)

(5) Improved agents

(6) Strategy presentation/tournament(Second)

(7) Preparation of report

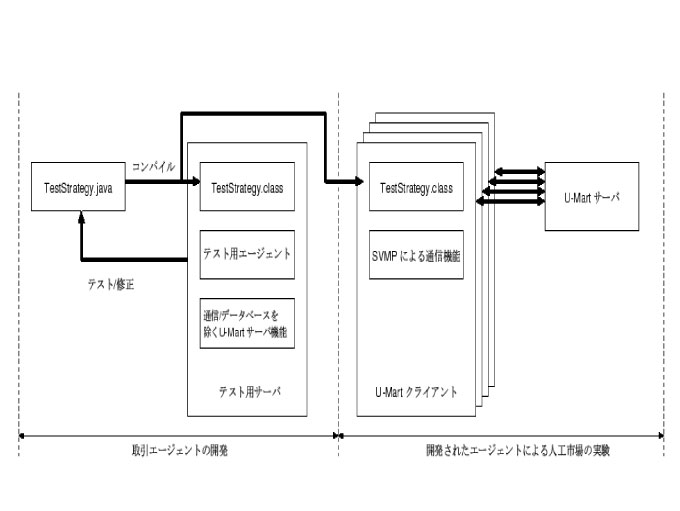

(8) Agent development kit

・Originally Tokyo Institute of Technology had developed

the kit for use in an exercise class, and Tokyo University used it for an exercise too.

・Formal expressions of strategies

Input: Spot, futures price series, position, and holding cash

Output: Selling/buying, order quantity, and index

・Expressed a strategy as one class/method of Java and coded it.

・Components of the kit

Development package: Trading with built-in agents

It works as a stand-alone at each student’s hand

- Students worked on it with interest.

- Students with various skills attended the class

- Event a simple theory would do in the market. (Invent a simple theory that would do in the market)

- Some students who were interested in finance implemented the typical technical analysis or arbitrage theory. - Some students tried to improve the accuracy of forecasting by implementing regression analysis or approximation of function.

- Levels and achievements of students

- As for third year undergraduates, their major issue was that if they would be able to express their own strategies in codes.

- As for graduate students, they were able to try more sophisticated strategies. - Tools must be improved.